The Budget decision exempting superannuation drawings from tax was clever. The Treasury Department estimates it will cost nothing in 2006-07, $1.6 billion in 2007-08, and $2.3 billion a year in the following two years — not much in a $270 billion budget.

In the short term it targets people close to retirement. Unlike the present concessional tax arrangements which apply from age 55, the exemption applies from age 60, and is not effective until July 2007, when we can expect to see pent-up expenditure as people withdraw tax-free funds from their accounts, stimulating retail expenditure in the 2007 pre-election period.

Treasury explains that it is about simplifying the system (which is remarkably complex) and encouraging saving. It provides a modest boost to people's retirement incomes; if that $2.3 billion were spread evenly across Australia's 2.7 million people aged over 65 it would come to about $850 a year per person.

In the long term, however, this exemption is irresponsible. It raises inequities, weakens the government's revenue base, distorts incentives and increases people's dependence on the financial sector.

Raising inequity and distorting lifetime income

The $2.3 billion will not be spread evenly. Superannuation lump sums up to $124,000 are already exempt from taxation. The average superannuation account balance is only $20,000. Because many people hold multiple accounts the balance per person in the labour force is around $35,000 — still well short of $124,000. For the near future the benefits will flow only to that 15 per cent who exceed the $124,000 threshold.

It will be many years before most people accrue significant balances, but that time will come. If someone aged 22 entered the workforce in 2002 (when the nine per cent contribution rate started), has unbroken employment with average earnings to age 65, and invests in a low-cost industry superannuation fund, he or she will accumulate enough to enjoy a pre-tax retirement income of about 90 per cent of average earnings. When retirement income is exempt from tax, one's disposable income will probably rise on retirement, for low income earners (eligible for the Senior Australian Tax Offset) and for high income earners who had been paying 40 or 45 per cent tax in their working years.

In our years of heavy financial needs, when we are paying off mortgages and bringing up children, we are forced to sequester our savings into superannuation. We may have to skimp on outlays for our children, and we may be unable to afford to take the time we would like to spend with our families. As we age we pay off our mortgages, see our children become financially independent and we may benefit from an inheritance. When we cease working we are relieved from certain costs (commuting, meals, clothing) and are less reliant on tradespeople for household maintenance. Our lifetime income does not match our needs or the needs of our children.

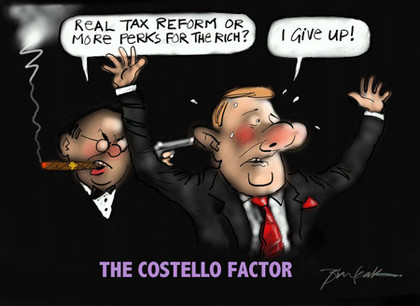

|

Thanks to Bill Leak.

The financial sector perpetuates the myth that superannuation needs lower taxes or higher contributions. In part this is because high fees in some funds can take up to 40 per cent of earnings; the industry wants concessions to compensate for its high costs. Also, many people with broken employment will have low balances, and it will be many years before the nine per cent contribution generates decent amounts. But to entrench privileges for superannuation, on the basis of these transitional problems and the industry's own extravagance, is irresponsible and inequitable — particularly towards children. Public policy should assist in matching lifetime income with lifetime needs, not distorting it even further.

Weakening public revenue

In this decision we see the irresponsibility of evaluating policy on the basis of short term projections such as Treasury's four year forward estimates period.

Superannuation balances have been growing at about seven per cent annually (in real terms), and should continue to grow, thanks in part to the incentives for salary-sacrificing and co-contributions and now the incentive of tax-free withdrawals in retirement. Those balances and the income from them are being taken out of a future tax base, apart from the modest earning tax (a nominal 15 per cent) when funds are in the accumulation phase.

Distorting incentives

From 2007 the promise of tax-free withdrawal from superannuation will actually entice many people into early retirement. That enticement is strongest for people with higher incomes and therefore higher superannuation balances, including those with trades and professional skills.

This government fails to understand what motivates people to work. People with modest incomes are motivated to work longer hours in order to earn more, but past a certain point higher income is not a sufficient incentive. Rather, as people accumulate wealth and know that income from that wealth will not be taxed, they will opt for less work and more leisure.

If a government wants to entice people to work it should address the effective high marginal tax rates applying to people making the transition from welfare to work. This government has failed, once again, to do this. Instead, by introducing the superannuation concessions and dropping the top marginal tax rate to 45 per cent, it is essentially letting the most well-off know that they can slacken off their work effort. It is a strange public policy which applies no tax to rentier income (income from passive investments), while focussing its tax base on those who work for a living.

Increasing dependence on the financial sector

The financial sector in Australia is highly privileged through measures such as compulsory superannuation.

Not only does it benefit from the four billion dollar annual fees and commissions in superannuation, but, because superannuation displaces other forms of saving, it benefits from people having to be more dependent on debt by taking out bigger mortgages and borrowing for major purchases such as cars.

The superannuation industry complains about taxes, but in reality superannuation savings are much more lightly taxed than normal savings. As an example, I have modelled two saving situations — both involving a person paying tax at 30 per cent and investing $1000 for 20 years. One person invests in superannuation; at the end of 20 years he or she has $1900 accumulated — a real (inflation adjusted) annual return of 3.4 per cent. The other makes a personal investment, and at the end of 20 years has only $1200, a real return of a miserable 1.0 per cent. In that situation the effective tax on superannuation is 36 per cent, while it is 60 per cent on personal investment. (The spreadsheet, into which readers may insert their own figures, can be downloaded here.)

If a policy were deliberately designed to discourage financial independence and to make people more dependent on personal debt, the government could hardly have done better. There is no incentive to save for contingencies, major asset replacement or children's education expenses.

When people have no easily realized savings, and when much of their pay packet is committed to paying off debt, they have lost their financial independence. They dare not walk out of a bad job or take part in a prolonged strike. Unable to pay cash for major purchases such as cars, their market power is limited. Without money set aside for contingencies they must take out expensive full cover insurance. We are regressing from a capitalist to a feudal state, where the new manor lord is the bank, insurance company, and superannuation fund.

The beneficiaries are in the financial sector. The finance, property and business services sector now accounts for 18 per cent of GDP. That's $8,400 a head every year, or $22,000 a household. The sector has been growing since the mid eighties (when it accounted for only 12 per cent of GDP), in spite of the huge savings made through the use of information technology. That's a huge bureaucratic overhead which the productive 82 per cent of the economy has to carry.

And insulting older Australians

The inequities and waste are bad enough, but perhaps the worst aspect of these changes is that they reveal a political belief that all older Australians care about is their personal comfort — that they have no desire to leave to the next generation a more prosperous, fair and decent society.

That's truly insulting.